A million-pound pension can provide you with financial freedom in retirement, but it may not deliver the millionaire lifestyle you think.

Having access to a £1 million can conjure images of an extravagant lifestyle, from chartering yachts to hitting designer shops. While having a £1 million pension can mean you can indulge in things you love or tick off items on a bucket list, you still need to think long-term.

Could you save £1 million in your pension?

It can seem like a huge challenge to save £1 million in your pension, but it can be easier to achieve than you think.

Often, you’ll be paying into a pension for decades. As a result, the amount you’re contributing to your pension can add up. On top of this, your employer will usually contribute on your behalf, and you will also receive tax relief. The money going into your pension will typically be invested over the long term, which can help your retirement savings grow. So, while you may think a £1 million pension is out of reach, you could be closer than you expect.

Keep in mind that the Lifetime Allowance limits how much you can tax-efficiently save into a pension in total. For the 2022/23 tax year, the Lifetime Allowance is £1,073,100, this is the total value of your pension, so it may include contributions from yourself, employers, and other third parties, tax relief, and investment returns.

If you exceed the Lifetime Allowance, you could face additional charges when you access your savings. So, it’s important to keep the limit in mind and track how the value of your pension changes.

The retirement income a £1 million pension could deliver

The income delivered by a £1 million pension will depend on a variety of factors, including:

- The age you retire and your life-expectancy

- Whether you want to take a tax-free lump sum from your pension.

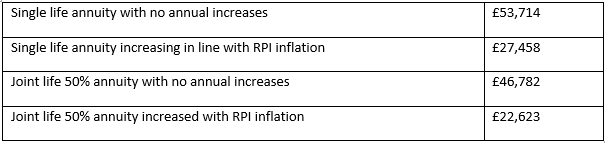

How you access your pension can also have a significant impact. According to research from Fidelity, a £1 million income used to purchase an annuity could provide an income from £22,623 to £53,714 for a healthy man aged over 65. That’s a huge difference that demonstrates why it’s important to consider your options and what’s important to you.

An annuity is something you buy that will then deliver a regular income for the rest of your life. It can help create financial certainty in retirement. When purchasing an annuity, you will have to make several decisions, including if you want the annuity to provide an income for your partner if you pass away, and whether you want it to increase in line with inflation to maintain your spending power. The below table highlights how the decisions you make with a £1 million pension can affect your income.

Source: Fidelity

The table is based on a male aged over 65 in good health and, for the joint life policies, a female dependent aged over 62 in good health. It’s important to note that annuity rates cannot be guaranteed. The rate offered will depend on your age, lifestyle and health, as well as the wider market.

An annuity isn’t the only way to access your pension, however. You may also choose to use flexi-access drawdown. This is where you can flexibly withdraw money from your pension while the rest will usually remain invested.

While you’d be in control of how much income you take, you need to consider what’s sustainable. Withdrawing too much too soon could mean you run out during your lifetime.

As a rule of thumb, you shouldn’t withdraw more than 4% each year for withdrawals to be sustainable. For a £1 million pension that would mean an annual income of £40,000.

However, while this rule can give you a general idea, it’s important to look at your own finances. Longer retirements can mean the 4% rule no longer makes sense and a lower withdrawal rate is appropriate. Investment performance could also affect the value of your pension. When using drawdown, you need to consider your circumstances now and how they could change over your retirement to ensure you’re financially secure.

Using cashflow modelling to understand your pension

While a £1 million pension can certainly provide security in retirement, it may not mean the lavish lifestyle that first springs to mind. It’s still important that you consider how to make use of your pension so that it provides an income for the rest of your life.

Whether you have £1 million in your pension or not, we can help you understand what level of income you can expect throughout retirement, as well as planning for unexpected costs you may face. We’re here to help you pull together other sources of income you may have too, such as investments, property, or savings.

We know that it can be difficult to visualise how your wealth and income could change over a retirement that may last decades. Cashflow modelling can provide you with a way to visualise how the decisions you make at retirement, and even before, can affect the rest of your life. It’s a process that can let you explore the different options and mean you have confidence in the future.

Please contact us if you’d like to arrange a meeting to discuss your retirement income and the lifestyle it can offer.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future results. The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates and tax legislation may change in subsequent Finance Acts.

Recent Comments