We have all heard the phrase ‘timing the market’. This phrase is often an investors downfall as the misconception to making money in the stock market, by investing when markets are rising and to dis-invest when markets are falling. We call this type of investing:

Feel Good Investing

While feel good investing may seem to be beneficial in the short term, we can assure you that it does not Feel Goodin the long term!

The difficulties with trying to time the market is that even the best brains and fund managers in the world cannot tell you whether the market will rise or fall, without this information it is nearly impossible to know the exact moment to invest and disinvest your money.

So what’s the best way to make profits?

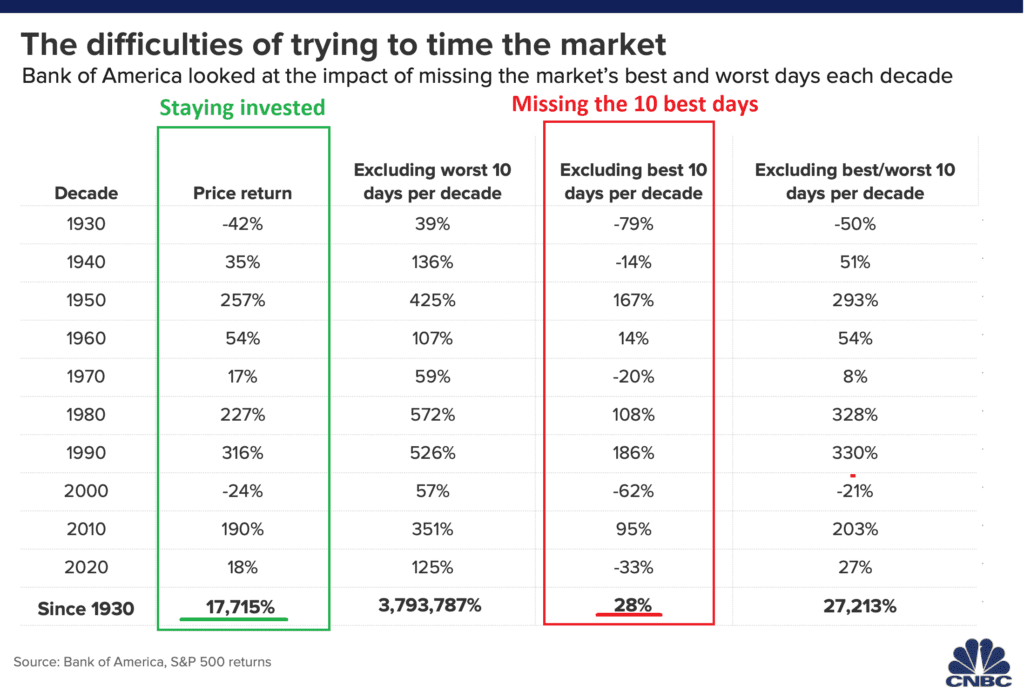

The answer to this is simple, just stay invested! Through disinvesting, you risk missing the best days in the market. It is far better to hit every trough in the market as well as hitting every peak by remaining invested. In fact, the benefits out way the negatives by thousands, just take a look at the graph below:

As you can see, by remaining invested through the 10 worst days of the decade as well as the 10 best days of the decade, since 1930 an investor would have made a gain of 17,715%! As opposed to the 28% gain by missing the 10 best days of a decade, that’s missing 1 day a year! Just in case the numbers above don’t speak for themselves, the odds of an investor being able to time the market and miss the 10 worst days as well as hitting the 10 best days in the market each decade is 0.5%! Whereas the odds of hitting the 10 best days in each decade is 100% by just remaining invested.

So next time there is a dip in the market think back to this newsletter as the figures show remaining invested gives far better odds of making a profit and having the future you dream of.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Recent Comments