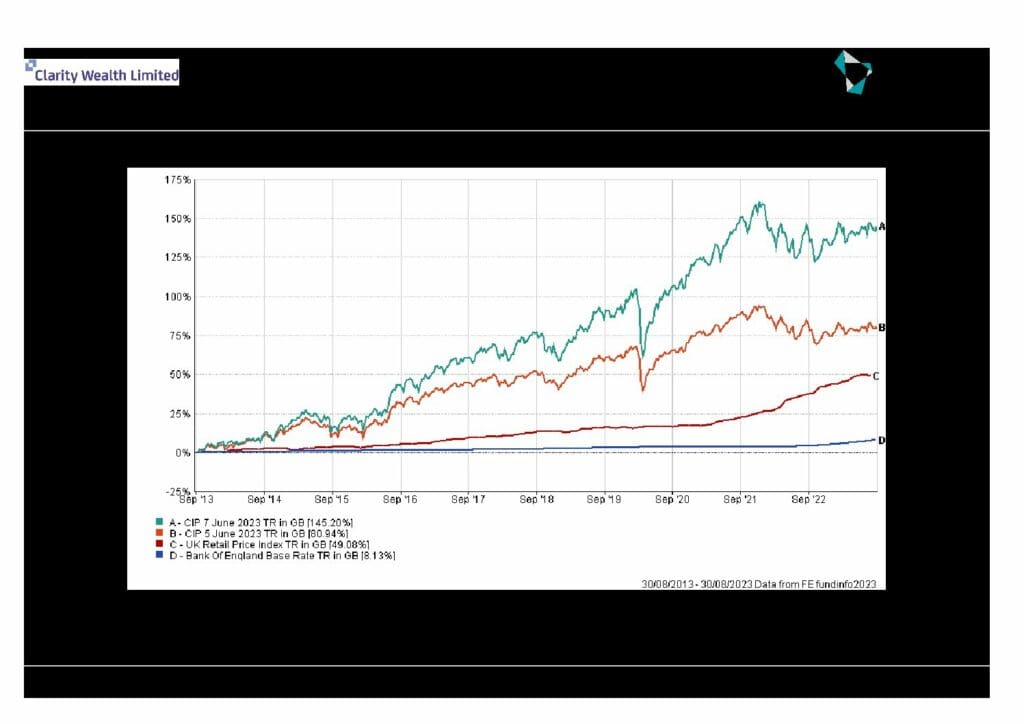

Every time It has happened it has always been different and “not like this before” yet every time it recovers stronger and for longer…????

Investing for the long term involves these ups and downs ⬆️⬇️

It would be great if it just kept making money every year but not every day is sunny is it? ☀️

Look beyond the short term and forget the noise..

- Inherent Optimism of Markets

One of the fundamental reasons the stock market bounces back is the intrinsic optimism that underpins market behaviour. Over the long term, stocks have historically shown a tendency to rise due to the growth of economies and companies. Investors, even in times of crisis, recognise the potential for economic recovery and future profit. This optimism contributes to the market’s ability to recover from declines.

- Economic Resilience

While economic downturns can lead to short-term market declines, economies have a remarkable history of recovery and growth. Economic cycles encompass periods of expansion and contraction, and these cycles are a natural part of market dynamics. Central banks, governments, and financial institutions often implement measures to stimulate economic growth, which in turn supports the recovery of the stock market.

- Innovation and Adaptation

Companies’ ability to innovate and adapt to changing circumstances is a key factor in the stock market’s resilience. Innovation can lead to new products, services, and technologies that drive growth and profitability. For example, the tech industry’s ability to continuously introduce groundbreaking innovations has contributed significantly to the market’s recovery from various setbacks

- Long-Term Investment Horizon

Many investors adopt a long-term investment horizon, recognising that short-term market fluctuations are a part of investing. Investors who focus on their goals and remain patient are more likely to weather downturns and benefit from the market’s eventual recovery. This long-term perspective reduces the impact of emotional reactions to short-term volatility.

- Diversification of Portfolios

Diversification is a risk management strategy that involves holding a mix of different assets. This approach helps spread risk and reduce the impact of poor performance in a single asset. Investors with diversified portfolios are better positioned to withstand market declines and capitalise on sectors that rebound, contributing to the overall market’s ability to bounce back

- Government and Monetary Support

In times of crisis, governments and central banks often step in with fiscal and monetary support to stabilise financial systems and stimulate economic activity. These interventions can include interest rate cuts, stimulus packages, and regulatory measures that help restore market confidence

Conclusion

The stock market’s ability to bounce back is a testament to the resilience of economies, companies, and investors. While short-term declines are inevitable, the historical trend of upward growth prevails. A combination of factors, including inherent market optimism, economic resilience, innovation, and prudent investment strategies, contributes to the market’s remarkable capacity to recover and thrive. Understanding these factors can help investors navigate market volatility and embrace the long-term potential of the stock market.

Look beyond the short term and forget the noise.

Recent Comments