When you see your portfolio value dip, the instinct might be to step aside and wait for more stable times. But often, this reaction can do more harm than good to your long-term financial goals.

Understanding the Cost of Exiting the Market

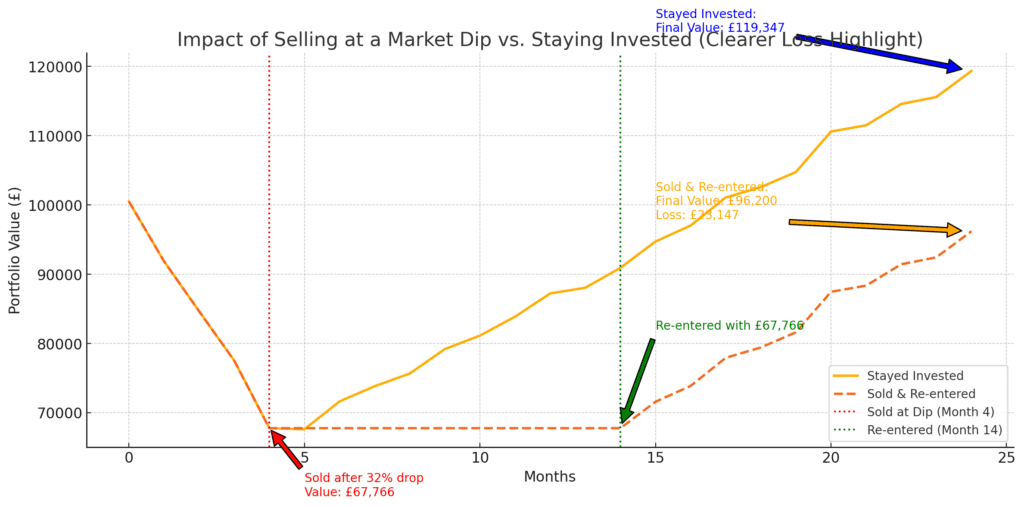

The graph below illustrates two investors who both started with £100,000. One stayed invested through a steep market decline of 32%, while the other sold at the bottom and re-entered after the market had partially recovered.

Investor A remained invested and saw their portfolio drop to £68,000 at the bottom of the dip. However, by staying the course, their investments recovered over time to £120,000.

Investor B, in contrast, sold at the bottom, also at £68,000, and held that value in cash until markets felt more stable. They re-entered at month 14 but missed a large portion of the recovery. As a result, their final portfolio value was only £104,000 — a loss of £16,000 compared to Investor A.

This example clearly demonstrates that trying to time the market often results in locking in losses and missing the recovery — the phase where many of the best days in the market typically occur.

The Unit Price Advantage

Most of the investment solutions we use at Clarity Wealth Limited are unit-priced. This means that every pound you invest buys a certain number of units, based on the current price. When markets are down, unit prices are lower — so your money buys more units.

By continuing to invest or staying invested during a downturn, you’re able to acquire more units at a discount. When the market recovers, the value of all those units increases, giving your portfolio a significant boost.

However, if you sell during the dip, you realise those losses — turning what could have been a temporary fluctuation into a permanent setback. Re-entering the market later often means buying back at a higher price and missing out on the recovery gains.

Why Long-Term Investors Should Stay the Course

Volatility is a natural part of investing. While short-term movements can be unpredictable, the long-term trend has historically been positive. For long-term investors, reacting emotionally to short-term market events can be costly.

This is exactly why we refer to our clients as long-term investors. It is often these very volatile periods that contribute most significantly to long-term growth. Historically, recoveries are not only more pronounced but also tend to last longer than the downturns that preceded them. This is where real long-term returns are generated — not by trying to avoid volatility, but by staying the course through it.

When investors sell during the dip and try to re-enter the market later, they often miss the strongest days of recovery, which can have a lasting negative effect on the overall value of their investments.

At Clarity Wealth Limited, we focus on helping our clients maintain a clear, long-term strategy aligned with their goals. By staying invested, continuing regular contributions (especially during downturns), and avoiding the urge to time the market, you give your investments the best chance to grow over time.

In summary:

- Selling during downturns locks in losses

- Re-entering later usually means missing recovery gains

- Staying invested allows you to benefit from the rebound

- Investing during dips buys more units at lower prices

- Volatility often precedes the strongest periods of market growth

If you’re concerned about market volatility or would like to discuss your investment strategy, please don’t hesitate to get in touch with your adviser at Clarity Wealth Limited. We’re here to help guide you through all market conditions with confidence.

Recent Comments