Due to the increase in bank rates at first sight it may be appealing to invest into cash but this is not a good idea for long term investing and will not ensure your money is protected against inflation over the long term. I shall explain with some visual aids…

I want to share 2 graphs with you…..

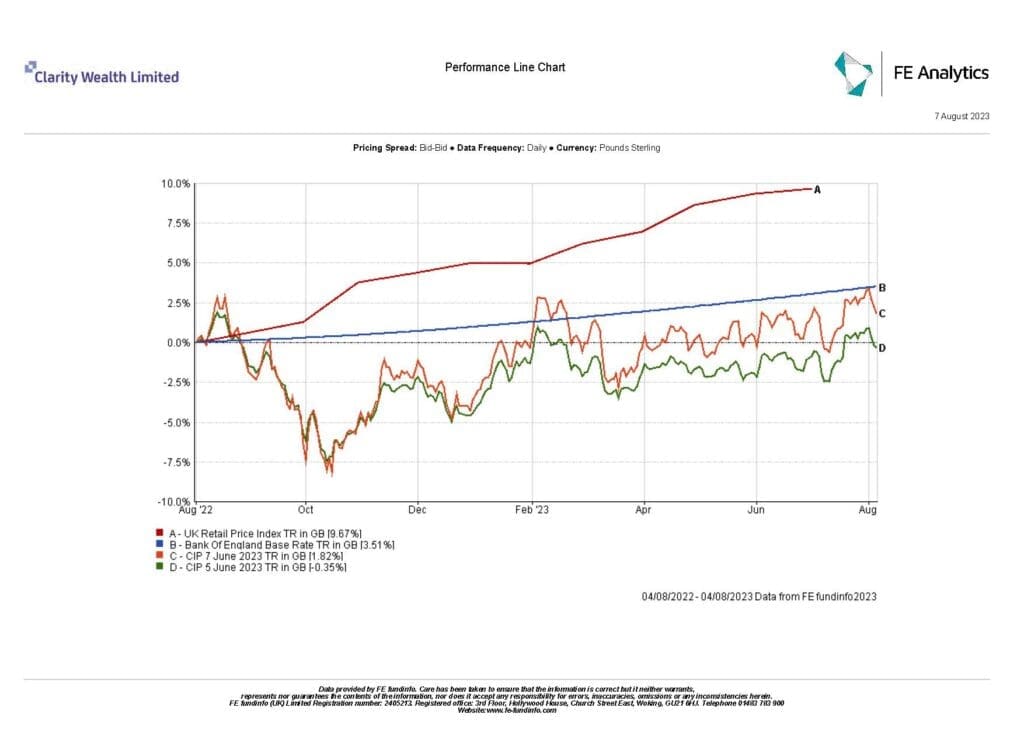

The graph above shows Inflation (A), bank of england base rate (B) and 2 investmentportfolio’s over the last year (C,D)- which one is keeping pace with Inflation (A)?

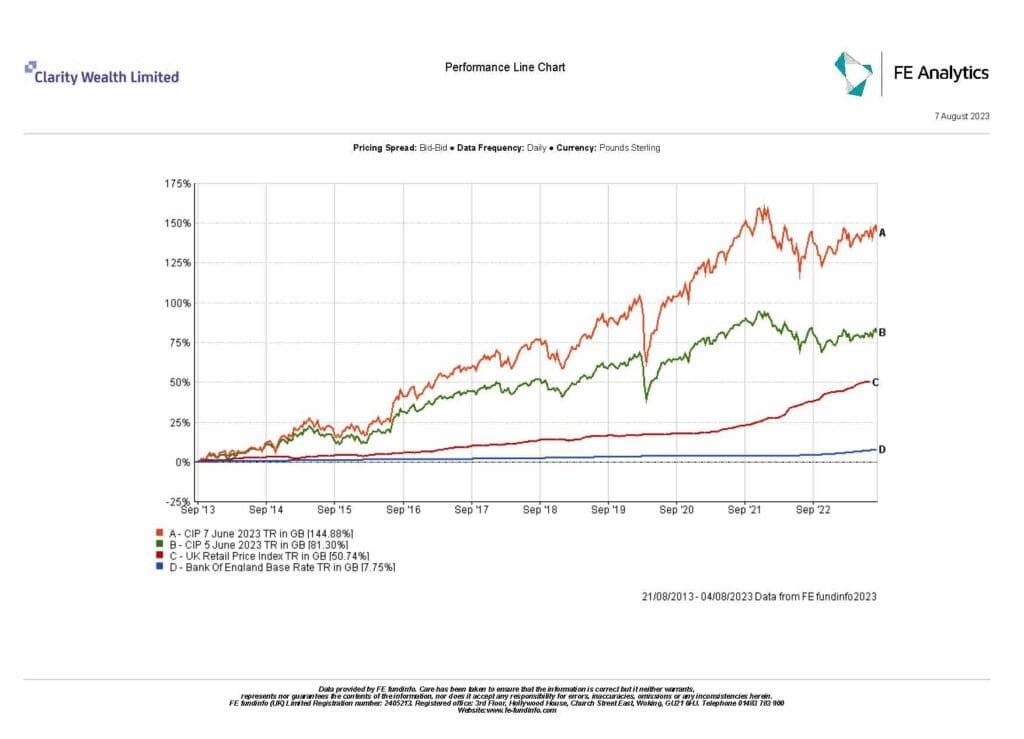

The graph above shows inflation (C), bank of england base rate (D) and 2investment portfolio’s (A,B) over the last 10 years – which one is keeping pace withInflation (C)?

Please read on….

- Over the last year inflation has outperformed (BoE) cash deposit and investment risk profile 5 and 7 (mixed asset investments)

- Over the last 10 years investment risk profile 5 and 7 (mixed asset investments) have outperformed Inflation and (BoE) cash deposits

In summary…

- If you invest into cash when markets are low and invest into the markets when they are rising you are going against the principles of the well known theory “buy low sell high” and will have missed the rally

- It is far better to spend time in the markets rather than trying to time the markets. This ensures you will capture the rally, which is often more pronounced and for longer but does not get the same attention in the media.

- If you invest into cash you will not beat inflation over the Long term

Please be advised that past performance does not indicate future returns

Please be advised that this is for information only and does not constitute advice

Recent Comments