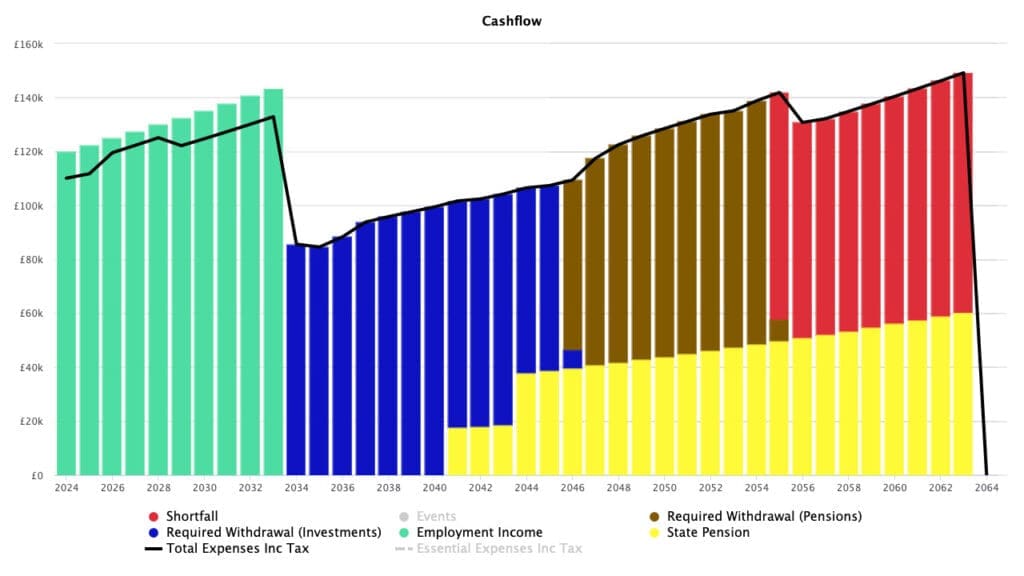

Cash flow modelling is a critical tool for individuals seeking financial freedom, and Clarity Wealth Limited offers comprehensive guidance on this subject.

The benefits of cash flow modelling include:

- Understanding Expenses: It helps you understand your current and future financial situation by examining your income and expenses. This is crucial for planning how much you need to save for retirement and how much you can spend once you retire.

- Budgeting: Cash flow modelling aids in creating a budget, allowing you to track your income and expenses and identify areas where you can save money.

- Pension Planning: It assists in making informed decisions about how to draw from your pensions, whether through lifetime annuities or drawdown options, to ensure a steady income during retirement.

- Tax Planning: It helps navigate the complexities of the tax system, ensuring you are aware of the tax implications of your income and expenses in retirement and can take advantage of tax reliefs and exemptions.

- Investment Strategy: Cash flow modelling can guide your investment strategy, helping you balance risk and return to meet your investment goals and ensure a sustainable future.

- Emergency Planning: It allows you to plan for emergencies by setting aside funds and ensuring you have a strategy to cover unexpected expenses.

- Long-term Projections: Cash flow modelling provides long-term projections of your financial situation, taking into account various factors like market conditions and personal circumstances, to ensure your funds last throughout retirement.

By utilizing cash flow modelling, Clarity Wealth Limited ensures that you are well-prepared for retirement, with a clear understanding of your financial situation and a solid plan to achieve financial freedom. For a detailed guide and personalised advice, Clarity Wealth Limited’s resources and financial advisors are available to assist you in this journey.

Recent Comments