Did you know that over 80% of UK savers are in default pension funds? While these funds offer convenience, they may not be the best choice when it comes to maximising your retirement savings. If you haven’t reviewed your pension in a while, you could be missing out on growth opportunities that make a real difference to your future financial security.

What Are Default Pension Funds?

Default pension funds are the standard investment option for workplace pensions. If you haven’t actively chosen where your pension contributions go, they are likely sitting in one of these funds. While default funds are designed to be ‘one size fits all’, the reality is that they may not align with your personal retirement goals.

Many default funds follow a lifestyling strategy, which means your investments are gradually moved into lower-risk assets as you near retirement. This sounds sensible, but it can limit growth potential—especially if you plan to retire later, take a flexible income, or keep your pension invested after retirement.

Why This Matters for Your Retirement

If your pension is sitting in a low-growth investment fund, you may not be getting the best returns on your money. Over time, this could significantly impact how much you have available when you retire. Consider these key factors:

✅ Lifestyling may not suit modern retirement plans – Many people now opt for flexible drawdown rather than buying an annuity, meaning they need their investments to continue growing beyond retirement age.

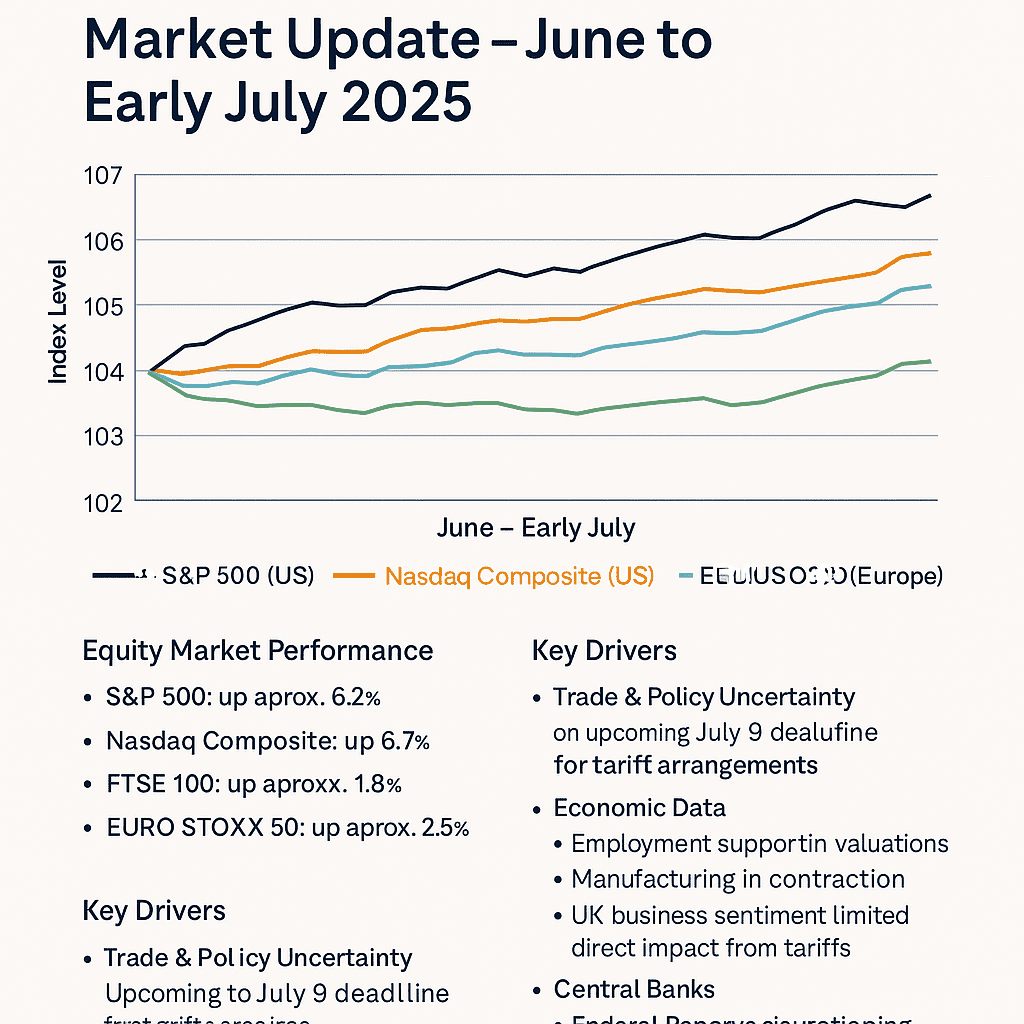

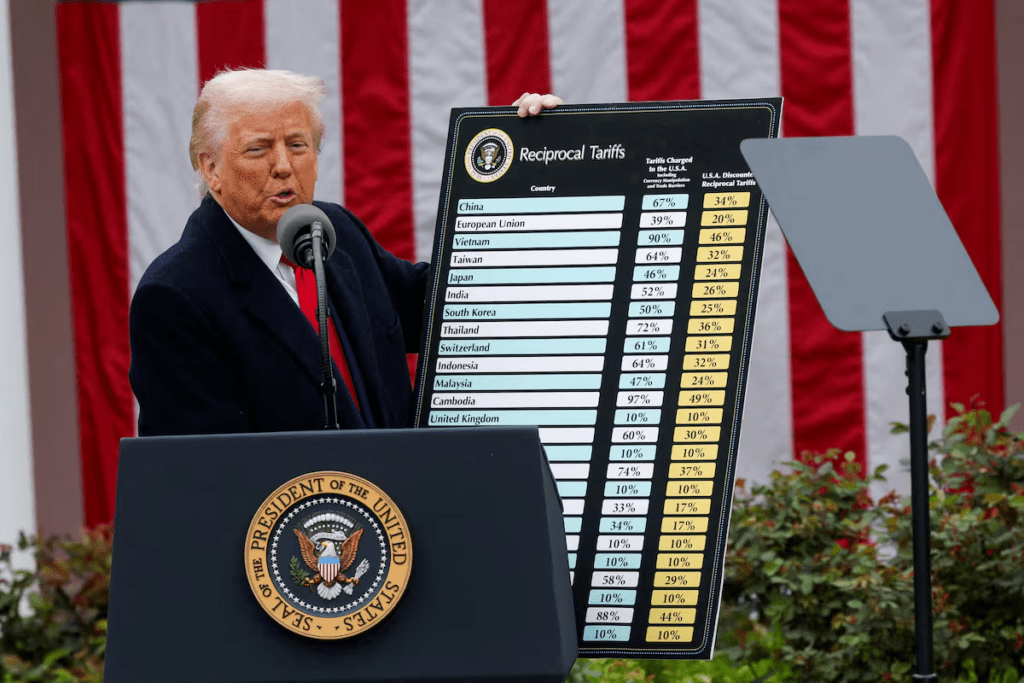

✅ Market conditions have changed – Some default funds may be too cautious, especially in a high-inflation environment where your savings need to work harder to maintain their real value.

✅ Every retirement journey is unique – Your financial needs and goals will differ from others, so a ‘default’ strategy might not be the best fit for you.

How to Take Control of Your Pension

🔍 Review your pension fund – Check if you’re in a default fund and whether lifestyling is affecting your investments.

🎯 Align your pension with your goals – Consider how you plan to access your pension in retirement and ensure your investment strategy supports that plan.

📈 Seek expert advice – A professional financial planner can help you optimise your pension strategy, ensuring it works as hard as you do.

Don’t Leave Your Retirement to Chance

Taking a proactive approach to your pension now can make a huge difference to your financial future. If you’re unsure whether your pension is working for you, it’s time to take action.

📧 Need help optimising your retirement savings? Contact Clarity Wealth Limited today:

🌍 Website: claritywealth.co.uk

📨 Email: service@claritywealth.co.uk

Your retirement is too important to leave to chance—make sure your money is working for you!

#PensionPlanning #RetirementSavings #FinancialFreedom #InvestSmart #UKFinance

Recent Comments