Even though I see it every day it still amazes me that people do not plan for life beyond work earlier on in their working life. I understand people are busy but don’t most people manage to plan for a holiday and how much they can spend? Surely you want to know what would happen if you stopped working or did something else?

I’m hesitant to use the word “retirement” as it conjures up images for some of losing their purpose or vegetating on the couch! People also don’t want to look too far in the future and imagine themselves as old, this also can create a reluctance to plan for the long term.

If we ask it differently like what would you do if you didn’t have to work? This helps people imagine a different future. What does it look like? What do you do each day and how much does this lifestyle cost. This is now interesting…

Cash flow modelling helps answer important questions that include.. How much do I need to invest to secure financial freedom? What is my current trajectory and how much can I spend if I stopped working at a certain age? When will I run out of money? Once we have unearthed these questions we can then look at strategies for fixing or planning for these goals. If you don’t have a plan how do you know where you are going to end

Clarity Wealth Limited utilises advanced cash flow planning and modelling software to create a tax-efficient roadmap personalised for each client’s financial goals. This planning approach incorporates income tax, capital gains tax, and inheritance tax, alongside pension withdrawal options, including UFPLS (Uncrystallised Funds Pension Lump Sum), flexi-access drawdown, defined benefit schemes and tax-free cash allowances.

Ensuring Efficient Product Wrappers for Each Life Stage

Based on the projections, our software evaluates the best product wrappers—ISAs, pensions, investment bonds, and more—tailored to maximise tax efficiency throughout your life. The modelling accounts for the timing and source of income, ensuring that the correct assets are drawn upon, whether prioritising current lifestyle or preserving wealth for family. This approach allows us to plan whether clients should fully utilise their wealth or save sufficient funds for heirs.

Using Scenario Analysis for Realistic Outcomes

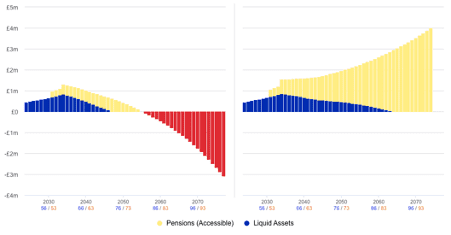

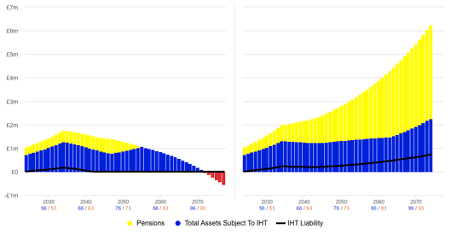

Scenario analysis provides a comprehensive view of potential outcomes by comparing, for example, a “Baseline Scenario” versus adjustments like contributing more to investments and reducing spending in retirement. Graphs in the report, such as the “Liquid Assets & Pensions” and “Estate on Death” projections, visually outline how spending, taxes, and inheritance value change based on different strategies, offering clarity around the impact of gifting, retirement timing, or spending goals on the lifetime of wealth.

Life-Changing Decisions, Made Clear

Annually updated, this planning tool enables clients to make informed, life-changing decisions, from charitable gifting to retirement adjustments and fulfilling “bucket list” aspirations. Whether clients are focused on immediate lifestyle goals or long-term legacy planning, we provide the guidance to help them pursue financial freedom with confidence and clarity.

This comprehensive approach is a core benefit Clarity Wealth Limited offers, ensuring that your financial plan evolves with every legislative change, personal milestone, and economic shift.

Recent Comments