The introduction of Auto-enrolment and the obligation placed on the employer is certainly a step in the right direction for the nation’s pension planning.

In an ideal world, everybody would be building up and saving for their retirement, in many cases, this could end up being 30% or more of a person’s life.

For many people, the state pension will form the backbone of their pension and this is likely to be the case for the foreseeable future.

As a result, it is crucial that everyone is clear on when they can access it and that they also know just how much they will receive.

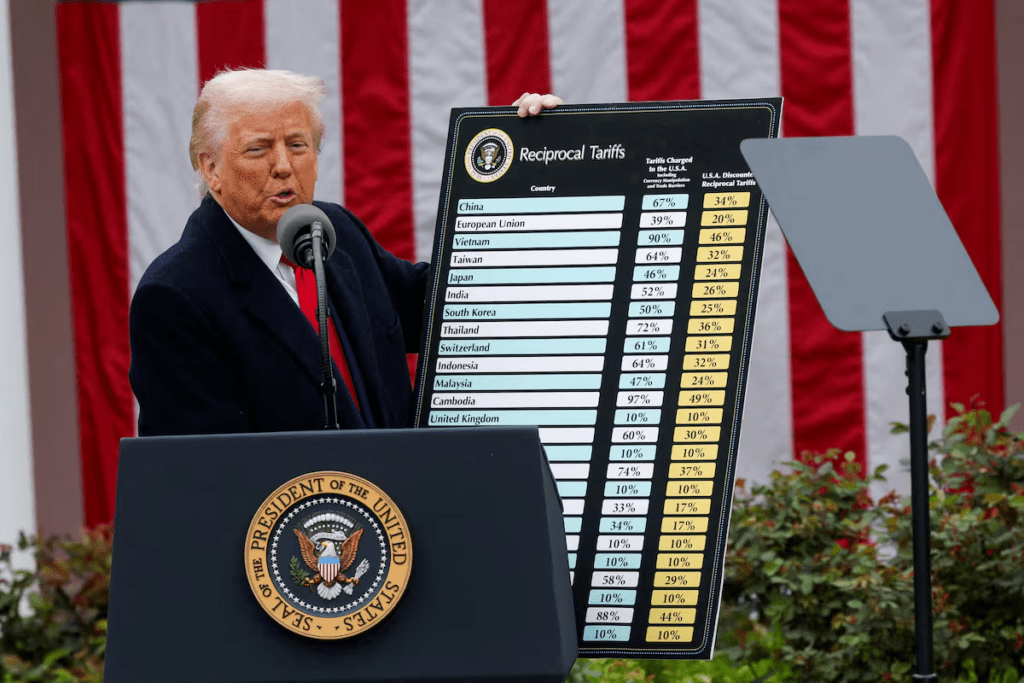

The State Pension system has undergone many changes – some more important and controversial than others over the past decade. It’s unlikely to stop there either, as the Government tries to control the cost to the public’s finances.

One measure that was brought in by Government was to increase the age for women to qualify for access to their State Pension in the form of state pension age equalisation. The pensions act in 2011 saw that this was increased from age 60 in 2010 to the same as men at age 65 in 2018.

Changes to The State Pension

In October 2020, both women and men will see their state pension ages equally extended to 66.

Rises in the future for State Pension ages will increase to age 67 in 2028 have already been passed by law. The minimum age for accessing private pensions will increase from 55 to 57 at the same time.

The Government also intend to increase the State Pension age even further to 68, initially pencilled in to be introduced between 2044 to 2046. However, many people believe that the economy may dictate these changes being brought in much earlier.

The Government face a difficult task in communicating these changes to the public due to the simple fact that people will not be happy about having to work longer. The public’s opinion on this matter can be gauged on their attitude to the changes introduced when the retirement age for women was pushed up to match that of men.

The full State Pension currently stands at £175.20p per week for people who retired after April 2016. For many people, the State Pension will not provide a sufficient enough income or lifestyle function on its own. Think about it, can you realistically see yourself living on £759.20 per month throughout your retirement? That’s the equivalent of working 20 hours per week at the national minimum wage. If you can’t, then you need to plan ahead and the sooner you do this, the better!

2010 saw the Government introduce the State Pension Triple Lock, guaranteeing that the State Pension will increase by whichever is the highest of:

- Average Earnings

- Inflation

- 5% per annum

As a result of the Coronavirus pandemic, the level of borrowing undertaken by the government has increased astronomically, pushing the country to its highest level of national debt since the 1960s. This in turn raises the question of how sustainable this will be in the future.

Considering that the State Pension is the largest single section of UK welfare spending, accounting for a staggering 42% of all spending in 2018 – calculated from the cost in 2016-2017 being £92 billion per annum, according to https://obr.uk.

We can certainly expect even more changes in the years to come to the amount and when we receive our state pensions.

Please Note

This article is for information purposes only and does not constitute as advice or recommendations. Please do not act based on anything you might read in this article. All content is based on our understanding of current legislation which is subject to change.

Recent Comments