Following on from last month’s newsletter, inflation can have a significant impact on your financial well-being, as it erodes the purchasing power of your money over time. To safeguard your finances against inflation, it is crucial to adopt proactive measures. In this article, we will explore effective strategies to help you prepare your finances and combat the effects of inflation.

To effectively combat inflation, it is essential to understand its causes and effects. Click here to view last month’s article were we explain in more detail as to what causes inflation.

Invest in Stocks:

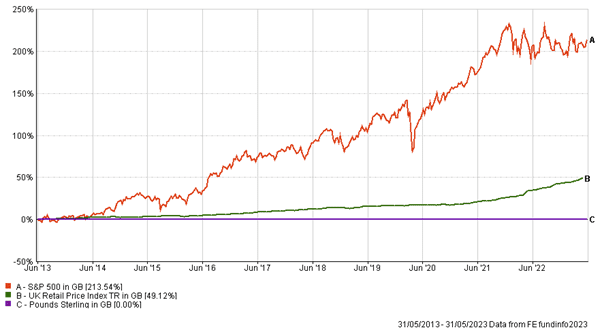

- Historically, stocks have proven to be a valuable hedge against inflation. Investing in the stock market can be a complicated and confusing task, consider consulting with a financial advisor to help you select suitable investment funds. Below you will see a graph that compares stock market investments to inflation.

Stock market investments vs. Inflation

Whilst interest rates have risen in the banks they are still nowhere near inflation. Over the long term cash has never beaten inflation. The above graph outlines the relationship between investing in the stock market (A) and cash savings (C) compared with inflation (B) over the last 10 years. As you can see cash savings can not keep up with inflation over the long term, whereas, investing in the Stock market over the last 10 years would allow an investor to outpace inflation and protect their money.

Build an Emergency Fund:

- Creating an emergency fund is a fundamental step in preparing for inflation. By setting aside a portion of your income in a separate savings account, you can create a financial buffer to cover unexpected expenses. Aim to save at least three to six months’ worth of living expenses to safeguard yourself during inflationary periods.

Diversify Your Investments:

- Diversification is a crucial strategy to combat inflation. Instead of relying solely on one type of investment, spread your money across different asset classes. Diversification helps reduce risk and allows your portfolio to potentially benefit from various inflationary environments.

Increase Your Income:

- As prices rise during inflation, it becomes crucial to increase your income to keep up with the higher costs of living. Look for opportunities to enhance your earning potential, such as negotiating a raise, acquiring new skills, pursuing higher education, or exploring side businesses or freelancing. Boosting your income helps offset the impact of inflation and provides greater financial stability.

Manage Debt Wisely:

- During inflationary periods, the cost of servicing debt can become more burdensome. Therefore, it is important to manage your debt wisely. Prioritize paying off high-interest debts, such as credit cards or personal loans, to reduce the strain on your finances. If feasible, consider refinancing your debts to take advantage of lower interest rates and potentially reduce your monthly payments.

Monitor and Adjust:

- To combat inflation effectively, you must stay informed about economic trends and adjust your financial strategy accordingly. Regularly monitor inflation rates, interest rates, and market conditions. Stay up-to-date with financial news and seek advice from financial professionals to ensure your approach remains aligned with your financial goals.

Preparing your finances to combat inflation requires a proactive and informed approach. By building on all of the above point you can protect your finances and minimize the impact of inflation on your wealth. Remember, each person’s financial situation is unique, so it is advisable to seek personalized advice from financial experts to tailor your strategy to your specific needs and goals.

Recent Comments