As the UK government implements its policy of “fiscal drag”, more earners are being drawn into higher income tax bands, resulting in increased taxation. It is crucial to understand the implications of these changes and explore effective strategies to manage your tax liabilities. This article will delve into the details and provide valuable insights for taxpayers, highlighting the importance of pension contributions in mitigating the impact of increased taxation.

Rise in Income Taxpayers: A Closer Look

HM Revenue & Customs estimates reveal a significant increase of 55% in the number of additional rate taxpayers during the 2023-24 tax year, reaching 862,000 individuals. Additionally, the number of higher-rate taxpayers is projected to grow by approximately 6%, totalling 5.6 million individuals. These numbers signify a significant shift in the tax landscape, impacting a large segment of the population.

Factors Influencing the Increase: Understanding the Dynamics

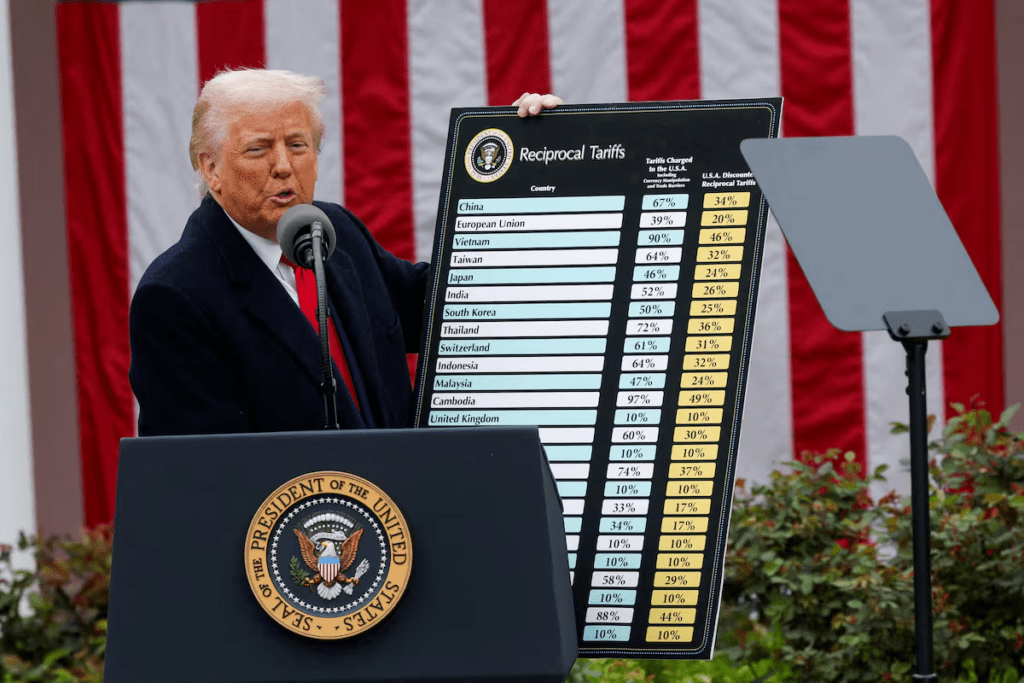

Multiple factors contribute to the surge in income taxpayers. Inflation-boosted pay awards play a crucial role in pushing individuals into higher tax brackets. Additionally, the government’s decision to freeze income tax thresholds until 2028 has a considerable impact. These measures, coupled with the recent lowering of the threshold for additional rate taxpayers from £150,000 to £125,140, further shape the tax landscape and affect individuals’ tax obligations.

Stealth Tax and Financial Challenges: Unveiling the Impact

Financial experts refer to these measures as a “stealth tax,” emphasizing the challenges faced by mortgage holders due to substantial rate increases. The freezing of income tax thresholds, along with sustained high inflation and interest rates, amplifies the financial strain experienced by households. It is essential to be aware of these implications and their potential effects on your financial well-being.

Mitigating the Impact: Harnessing the Power of Pension Contributions

One effective strategy to alleviate the burden of increased taxation is to consider increasing pension contributions. By diverting a portion of your income towards your pension, you can reduce your overall tax bill. This approach not only offers immediate tax advantages but also fosters long-term financial security. Maximizing pension contributions becomes a valuable tool for optimizing your tax position and managing your financial obligations effectively.

Planning Ahead: Taking Control of Your Financial Future

Staying proactive and well-informed is crucial in navigating the changing landscape of income tax bands. Regularly review and assess your financial situation and consider the impact of potential tax increases. Seeking advice from financial planners or tax experts can provide valuable insights and guidance tailored to your specific circumstances. By planning ahead and optimizing your tax position, you can secure your financial future and make informed decisions to protect your wealth.

As the UK income tax bands continue to evolve, it is essential for taxpayers to understand the implications and explore effective strategies to manage their tax liabilities. The rise in income taxpayers requires careful financial planning and consideration of valuable tools, such as increasing pension contributions. By staying informed, seeking professional advice, and taking proactive steps, individuals can navigate the changing tax landscape and secure their financial well-being in the face of increased taxation.

Recent Comments