I recently spoke with a potential client seeking investment advice. While this is a straightforward request, as an Independent Financial Adviser, it is important to consider the client’s broader circumstances as objectives in one area of life can affect decisions in other areas.

For instance…

- A young client may wish to invest their savings pot that will fund their first house deposit next year. With such a short investment window and small capacity for loss, adopting an aggressive approach may not be ideal

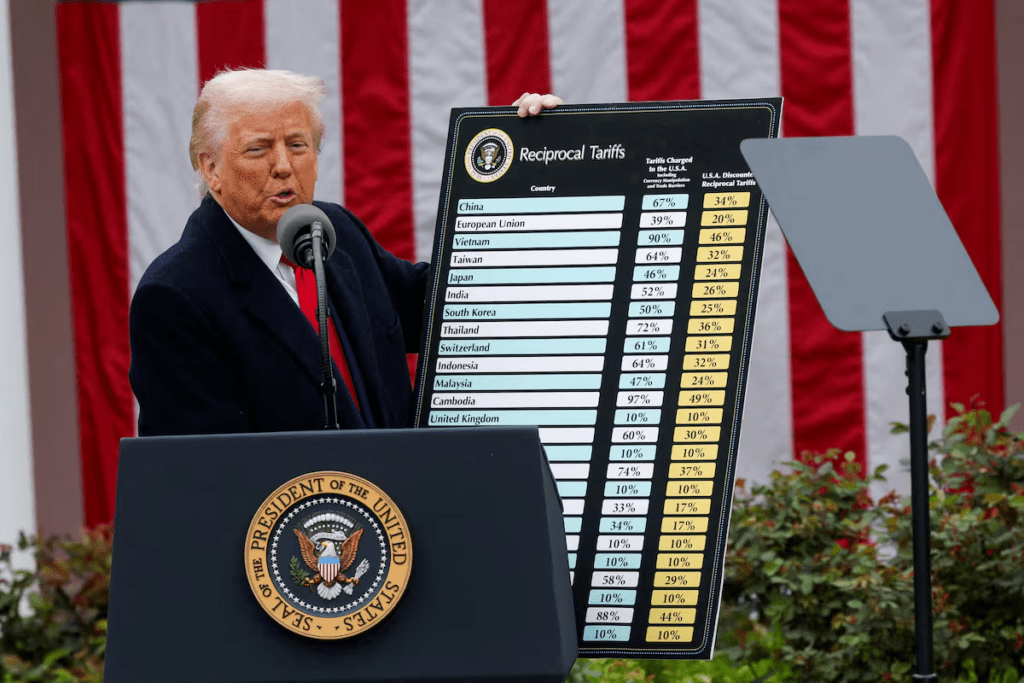

- A client may want investment advice for their General Investment Account (GIA) which has a restricted fund list and high fees. It may be worth exploring the market for more cost-effective and versatile arrangements, as well as considering other investment options, such as pensions or ISAs

- A high net worth client may want to invest for growth even though their income is met by their Final Salary pension and they are keen to reduce their Inheritance Tax liability. It could be advantageous to consider gifting or business relief qualifying investment strategies as an alternative.

These examples illustrate that the reason why we are investing is as important as the investment strategy itself. investment advice is deeply intertwined with an individual’s overall financial circumstances and objectives so tailored recommendations are crucial.

This is where holistic planning and ongoing service come into play. By assessing a client’s financial situation and objectives on a regular basis, we can develop a flexible and adaptable plan that evolves as their circumstances change, ensuring we stay on track to achieve their long-term goals.

Please contact me on 0113 258 6000 or email me at johnmount@claritywealth.co.uk if you’d like to chat about this with me in more detail.

Recent Comments