Investing in the stock market can be a great way to grow your wealth over time and there tend to be two main approaches to investing. Long-term Commitment and Timing the Market . In this article, we will compare and contrast these two approaches, and discuss the pros and cons of each.

Long-Term Commitment

A long-term commitment investor is someone who believes in the power of compounding and the long-term growth potential of the stock market. This type of investor is willing to hold on to their investments for an extended period of time, typically several years or more, and is not concerned with short-term market fluctuations such as market crashes and downturns.

Pros:

- Reduced risk: By holding on to investments for a long period of time, long-term investors can reduce their overall risk and benefit from the power of compounding.

- Reduced stress: By focusing on the long-term, long-term investors can avoid the emotional ups and downs that come with short-term market fluctuations.

- Reduce missed opportunities: By remaining invested you reduce almost all risk of missing bull markets/ market rallies following market downturns.

Cons:

- Tying up funds for extended periods: By committing to a long-term investment strategy, long-term investors benefit by ensuring they leave their funds within the markets for potentially years as opposed to drawing on them regularly.

Timing the Market

Market timing investors are those who attempt to time the market by buying and selling their investments based on short-term market movements. This approach is based on the idea that it is possible to predict market movements, buying low and selling high.

Pros:

- Potential for higher returns: Market timing investors who are successful in predicting market movements can potentially earn higher returns than long-term investors.

Cons:

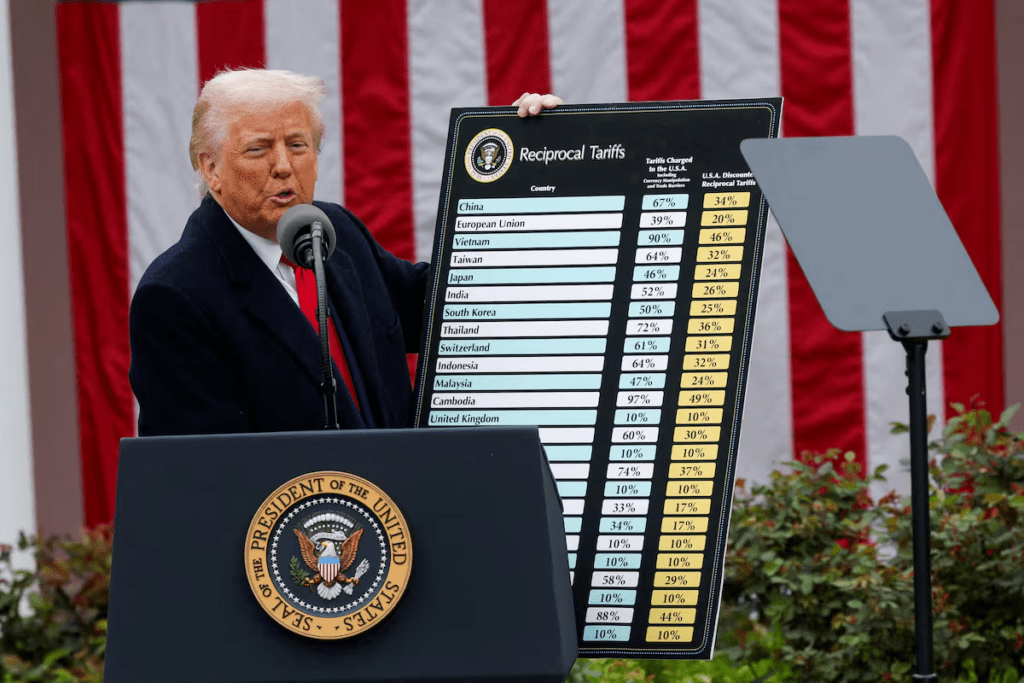

- It is impossible to predict the future of market movements

- Increased risk: Market timing is inherently more risky than a long-term investment approach, as it requires the ability to make accurate predictions on market movements.

- Increased costs: Market timing investors generally have higher trading costs, as they are constantly buying and selling their investments.

- Increased stress: Market timing can be emotionally draining, as it requires constant attention to market movements and the ability to make quick and potentially life changing decisions.

- Missed opportunities: in order to maximise the benefits of timing the market you would need to sell and invest at exactly the right time, by missing a trade by just one day could cause significant losses over time.

Timing the market all comes down to one word, prediction. According to the Cambridge dictionary the definition of prediction is ‘a statement about what you think will happen in the future’. The very definition itself uses the word think, as there is no way of factually predicting the future. So timing the market will always have an element of luck, as there isn’t a human being alive that can tell you whether the markets will rise or fall on a given date with 100% accuracy.

So back to the original question… to commit, or not to commit: that is the question: Whether ‘tis nobler in the mind to remain invested and commit to the bear markets and downturns in the pursuit of outrageous fortune, or to take to timing the market and face a sea of troubles, and potentially ending all hopes of fortunes? To sell: to buy; No more; and, by staying committed we end the heart-ache and the endless missed opportunities, ‘tis a recipe for success, a thing devoutly to be wish’d. To buy, to sell; To time the market: perhaps this is just a dream and a thing of luck: ay, there’s the rub.

In conclusion, the only type of investor that will see stability and the highest chance of making positive returns, is the committed one. Jumping in and out of the market is one of the highest risk ways of investing and commonly ends in devastation. If you would like to know more please click here to get in touch.

Recent Comments