Financial freedom is the state of having enough savings and investments to cover your living expenses without relying on a steady income from a job. It’s a goal that many people aspire to, but few actually achieve. In this article we will explain why we believe everyone should strive for financial freedom and a few steps which could help you achieve this goal.

Why should I strive for financial freedom?

As financial advisers we have seen every financial situation you could imagine and its because of this knowledge we can confidently say that obtaining financial freedom is a vital goal we should all aspire to achieve. For those reading this article we would like to take a minute to reminisce over past events:

COVID-19:

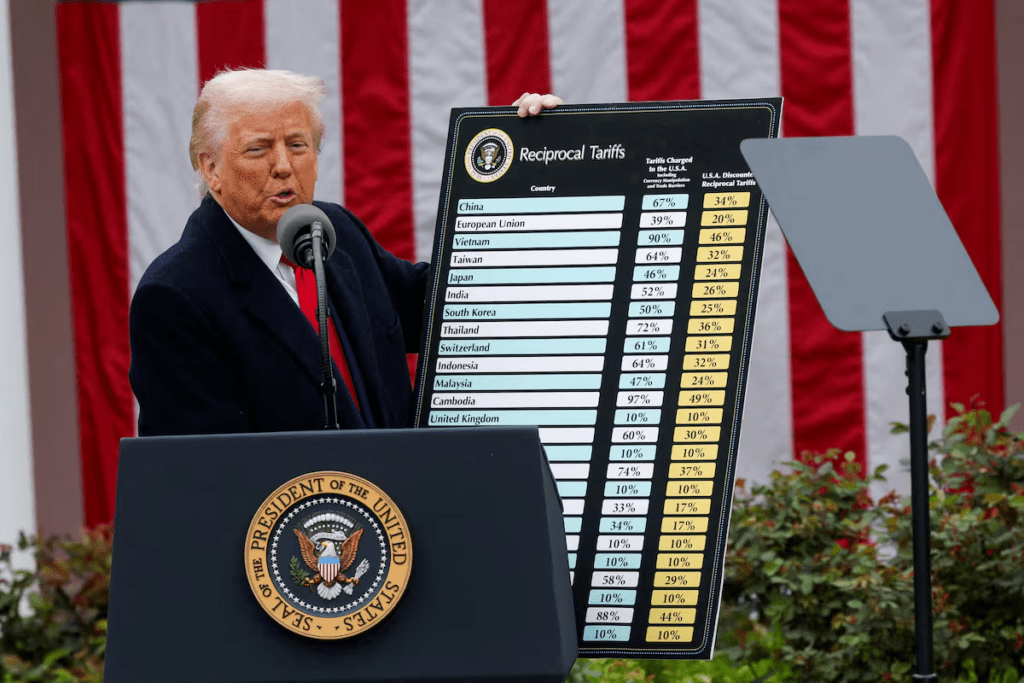

We apologise that we have brought up this subject as we are all beginning to get back to normal and put the pandemic behind us. In December 2019 the first human cases of COVID-19 were identified. The months following no one could have anticipated and come March 2020 the first lockdown was announced. During this time many individuals were furloughed, many individuals were made redundant and businesses had been forced to close their doors for good.

The energy price cap:

Not long after COVID-19 started to die down we then started seeing rises in our energy costs. Again, this had caught many individuals off guard and has caused many households to worry about how they will pay their energy bill.

These are just two examples of financial pressures that this country has had to face over the years and there will undoubtedly be many more events like this in the future. So imagine how differently things would be if you had financial freedom. The common misconception is that financial freedom means you need to be on the Forbes list of the world’s richest people. This is not the case, financial freedom looks very different for everyone’s individual needs. Financial freedom is making the necessary preparations to ensure that you can remain financially stable, despite what is going on in the world and therefore eliminating/ greatly reducing any financial stresses. For example, if your outgoings are £1,000 per month, financial freedom for you would be knowing that your savings, investments and income can support your expenses for the foreseeable future despite any external stresses the world has to offer.

How do you achieve financial freedom?

The idea of eradicating/alleviating any financial pressures is great but it takes a lot of hard work to actually be able to achieve. Here are a few things you could implement to get one step closer to achieving this goal.

- The first and most important thing to be able to achieve financial freedom is commitment and dedication. This goal will be impossible to achieve unless you are willing to commit to each step in its entirety.

- Determine your monthly expenses: To start your savings plan, you need to know how much money you’re spending each month. This includes all your fixed expenses, such as rent/mortgage, utilities, and insurance, as well as your discretionary expenses, such as dining out, entertainment, and travel.

- Establish an emergency fund: Before you start saving for financial freedom, you need to make sure you have an emergency fund in place. An emergency fund is a savings account that you use to cover unexpected expenses, such as a car repair, medical bill or unforeseen global events like COVID-19 and the energy price cap. Aim to save enough money to cover three to six months of living expenses.

- Pay off debt: High-interest debt, such as credit card debt, can be a significant roadblock to financial freedom. Paying off this debt should be a top priority.

- Create a savings plan: Now that you have an emergency fund and are on the road to becoming debt-free, it’s time to start investing for financial freedom. A good rule of thumb is to investing 15% to 20% of your income each month. You can save this money in a variety of investment accounts, such as a retirement account or ISA.

- Invest in a diversified portfolio: To reach financial freedom, you’ll need to invest your savings. A diversified portfolio of stocks, bonds, and property can help ensure that your investments are working hard for you. Understanding which investments are suitable for your needs is a daunting task, click here to get in contact with us and we can provide our advice on your best options.

- Re-evaluate your plan regularly: Your financial goals and circumstances may change over time, so it’s important to regularly re-evaluate your savings plan.

In conclusion, investing for financial freedom takes time, discipline, and planning. However, with a well-thought-out plan and a commitment to saving and investing, anyone can achieve this goal regardless of how much you earn. Finally, do not wait to start saving! The earlier you start the quicker you can achieve your goal.

Book and appointment with us here and we can help you on you journey to achieving financial freedom.

Recent Comments