Saving money is essential for financial security and achieving your long-term goals. Clarity Wealth Limited brings you five top tips to help you save money from your monthly income effectively. It involves commitment, planning and a long term vision and strategy! Let’s dive in! 🏊♂️

1. Set Clear Financial Goals 🎯

Start by defining what you’re saving for. Is it a new home 🏡, retirement 🏖️, or an emergency fund 🚑? Having clear goals will guide your saving habits and help you stay motivated. How much income or money do you want and when do you want or need it for? Do you want to still spend what you spend now when you decide to stop working? This needs planning for and will not happen automatically.

2. Budget and segregate Your Spending 📊

Create a budget that works for you and stick to it. Keep track of your income and expenses to ensure you’re not overspending and segregate your income. Commit certain amounts to saving for the short term, medium term and long term. This will ensure you control where the monies should be invested or saved in the most appropriate place. A common mistake is that long term monies are often left in cash based accounts or continually rolled over in 1 year bonds but they won’t keep pace with inflation over the long term and as such will diminish in value.

3. Cut Unnecessary Expenses ✂️

Review your monthly expenses and identify areas where you can cut back. Cancel unused subscriptions and opt for more cost-effective alternatives.

4. Automate Your Savings 🔄

Set up automatic transfers to your savings account. This ensures a portion of your income goes directly into savings, investments and pensions making the process effortless and pre-planned.

5. Invest monthly into a Pension Plan and Investment ISA 📈

Pension Saving: Investing in a pension plan is a powerful way to prepare for retirement. The benefits include tax relief, employer contributions, and the compound growth of your investments over time.

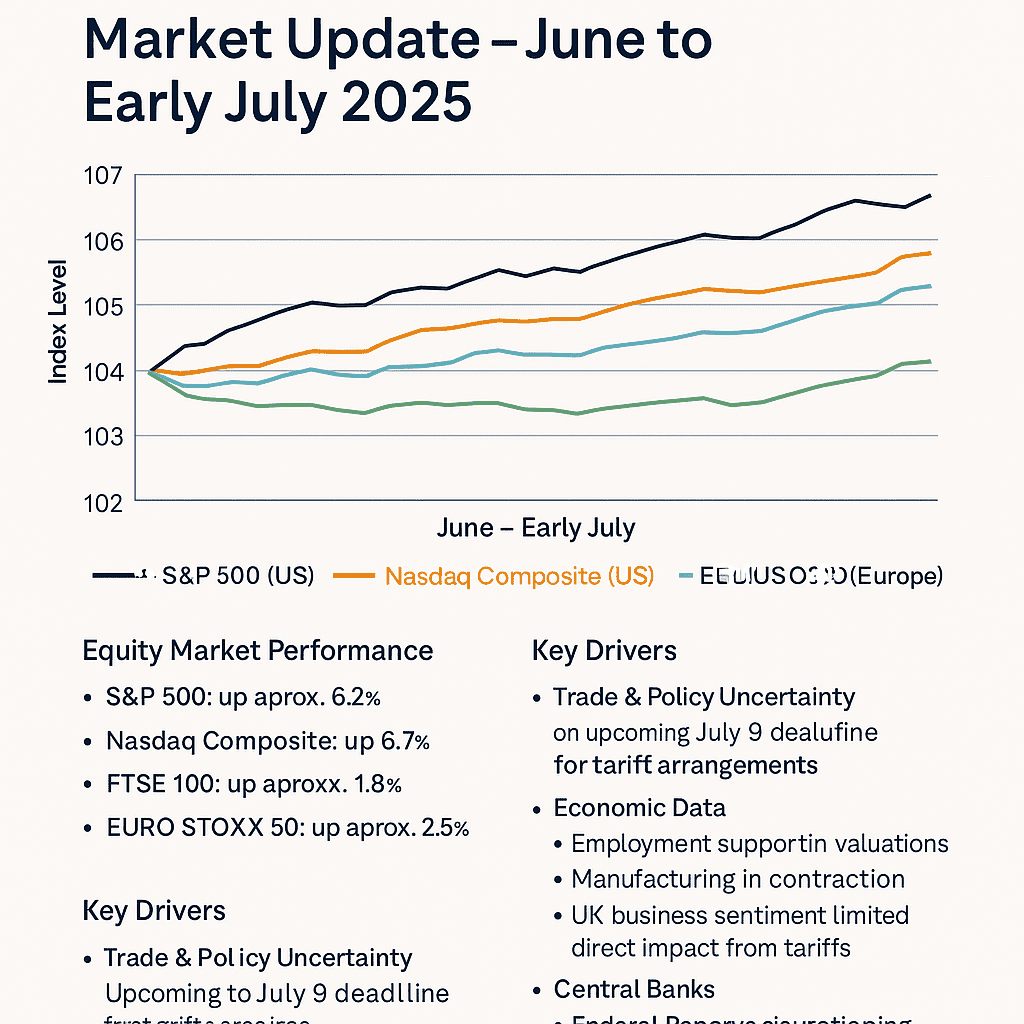

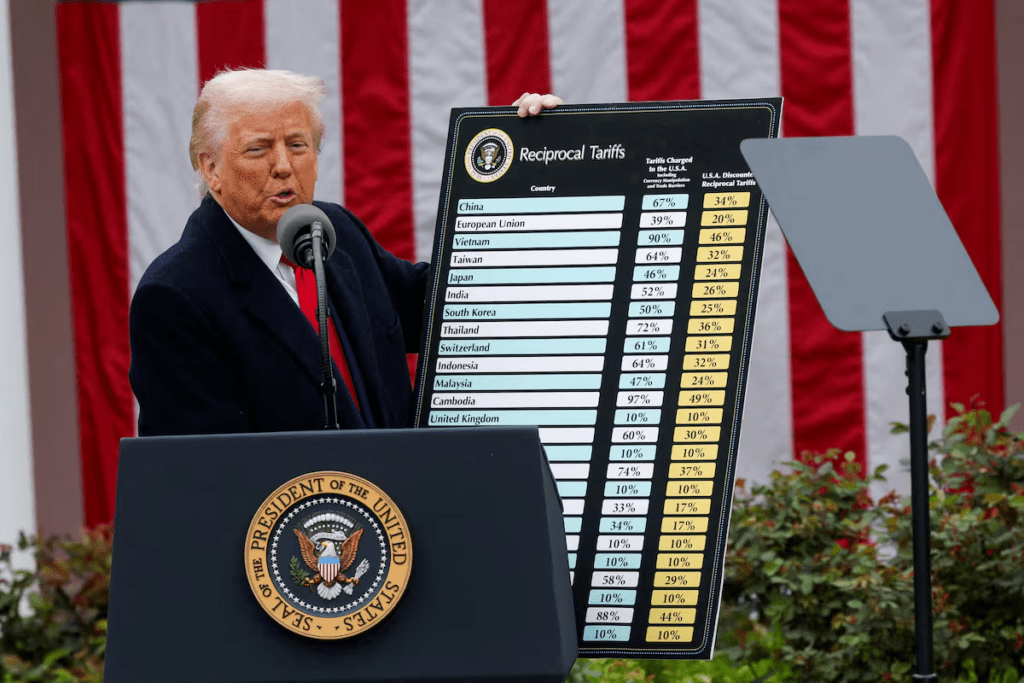

Regular Investing: Embrace the strategy of pound cost averaging. By investing a fixed amount regularly, you reduce the impact of market volatility and potentially lower the average cost per share over time.

By following these tips and understanding the benefits of pensions and pound cost averaging, you can take control of your finances and build a robust financial future. Remember, consistency is key 🔑. Start now and watch your savings grow with Clarity Wealth Limited! 💼🌱

Recent Comments