The media and financial markets have a complex and dynamic relationship that can impact the financial world in a number of ways. The media plays a crucial role in shaping public opinion and providing information about the financial markets, while financial markets are highly sensitive to media coverage and can be impacted by news reports.

One way that the media can impact financial markets is through the circulation of information. News reports, articles and analyst opinions can influence investor sentiment, causing market volatility. For example, a positive news report about a company’s earnings can cause its stock price to rise, while a negative report can cause it to fall.

The media tends to focus on negative and sensational stories, rather than positive developments, in order to capture the attention of viewers and readers. Positive market movements, such as a bull market or a rally, may not always be as newsworthy or sellable as negative events, such as a market crash or a financial scandal. Continuing from this, positive market movements can sometimes be driven by factors that are not easily visible or understood, making it difficult for the media to provide a complete picture of what is happening in the financial markets.

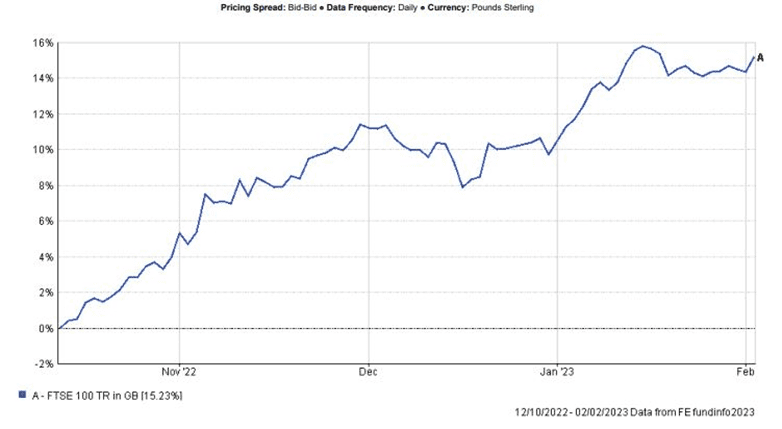

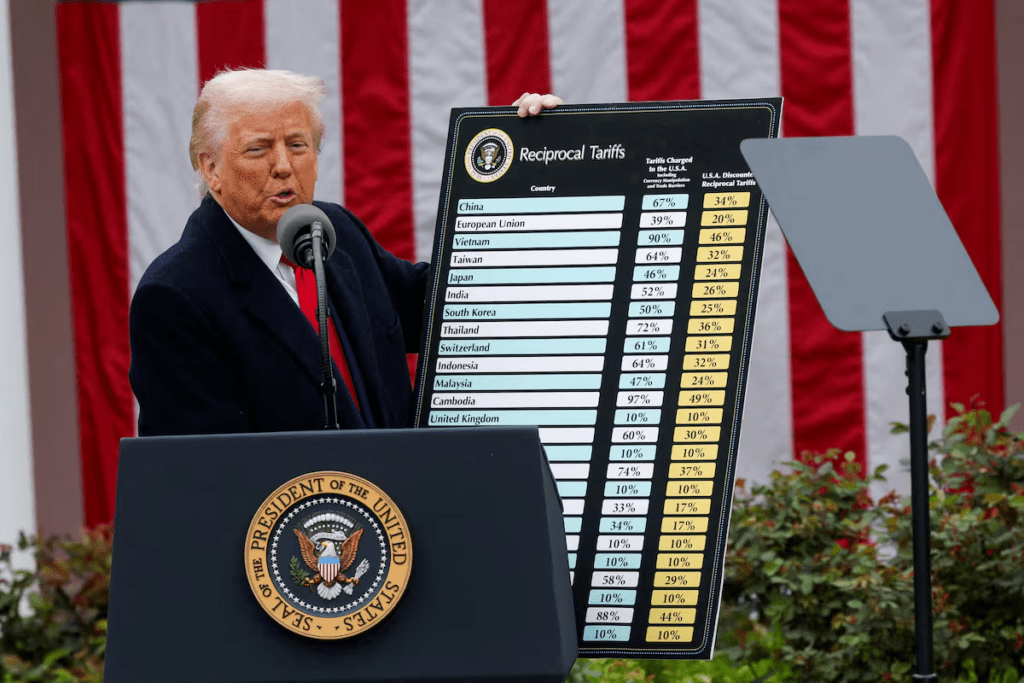

I bet you haven’t seen any positive new articles about the rise in the markets. In fact the FTSE 100 has risen by over 15% in around 5 months as detailed in the graph below.

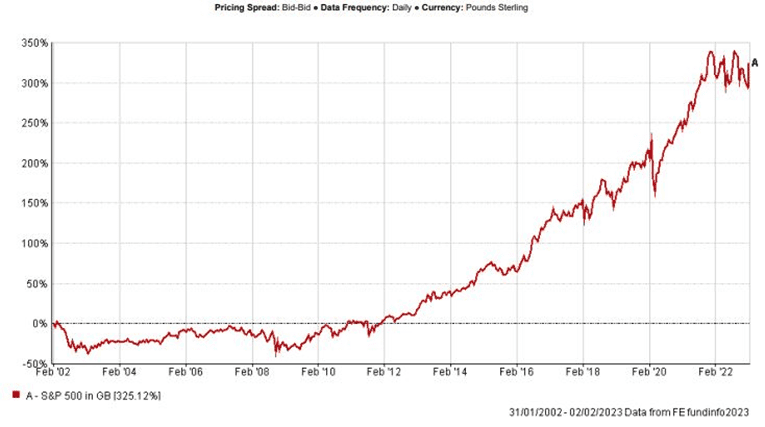

There has been media silence regarding this rally in the FTSE 100, which is a big difference compared to October and November last year when there were daily updates on the market “crashes” and declines. The markets will always reward the patient and committed investor and this has always been the case. With every market crash there has always been a rise, whether that is a steady rise over a few years or a sharp jump over a few months. Below is a graph which shows the SANDP500 through every crash in the last 23 years.

In conclusion, it is vital not to jump to conclusions or allow the media to convince us that we are in a state of financial disarray. We have seen many market crashes within our lifetime and we will undoubtably see more in the future. The key is to stay the course and not to panic whenever things seem bad as there is always a rainbow after the rain. If you do have any concerns regarding any market movements whether they are positive or negative, that is what we are here for. Click here and we can answer any questions you may have.

Recent Comments