Saving and investing for retirement

There are several ways to save and invest for retirement, such as through cash savings, employer-based pensions and personal investment accounts i.e. a SIPP or ISA. It’s important to choose the right options for your situation and to start saving and investing as early as possible, as this can give your money more time to grow.

*Below we will layout 2 scenarios for what a personal pension could look like for a lower rate tax payer and a higher rate tax payer. Both scenarios are based on a single wage from the age of 18 to 68 with an assumed investment growth of 5% per annum. The annual income is worked out to an individual who requires income to the age of 100.

Lower rate tax payer:

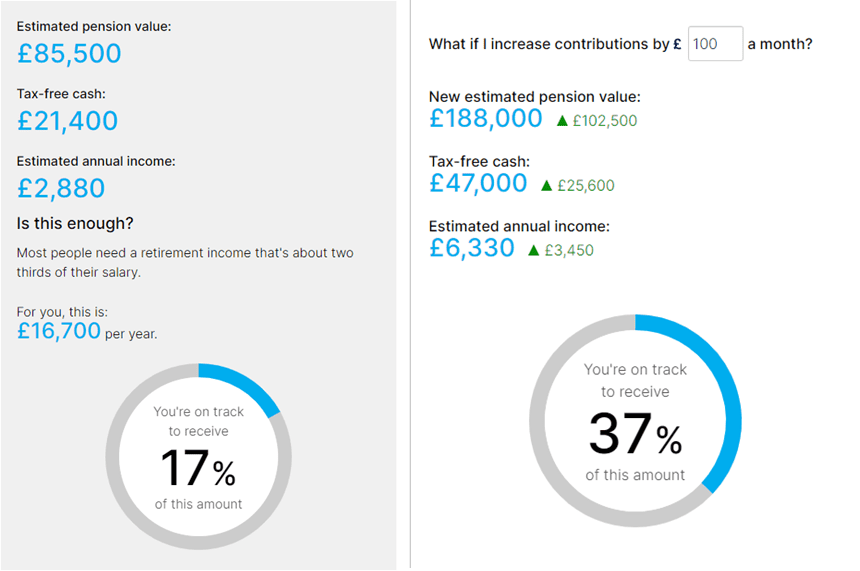

With this scenario we have taken a salary of £25,000 per year with a monthly contribution of 4% which works out to £83.33 and will increase to £104.16 after tax relief.

This example is working on the assumption that two thirds of an individual’s salary prior to retirement is required in for retirement be financially sustainable. In practice the amount you will need in retirement will be vary and is specific to your circumstances.

The grey box compares the value of a pension pot investing 4% of your gross monthly income and the white box shows the value of a pension with an additional £100 per month contribution.

As you can see by only relying on a personal pension it could have drastic financial consequences and could mean that you only receive income of 17% of your salary at retirement. By upping your contributions by an additional £100 per month it increases the value of this pension pot by £100,000 and the potential income increases by 20%.

What about your state pension?

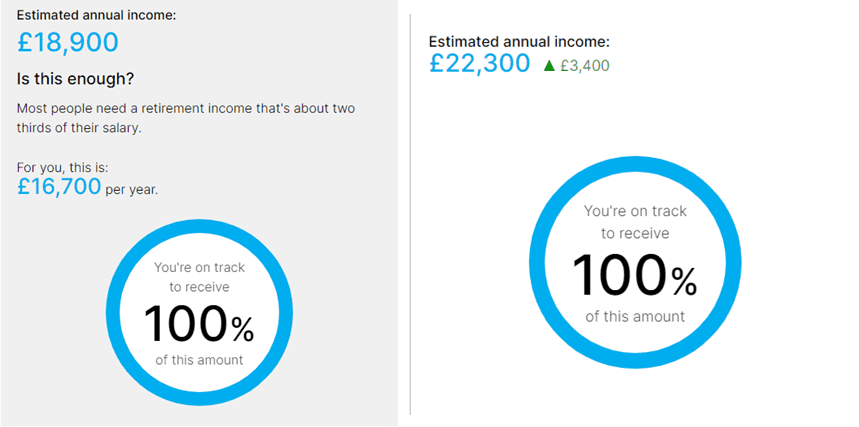

If you have been contributing to national insurance you will also be entitled to a state pension. Below is the same scenario as before but we have added on a full state pension entitlement.

From this we can see that in both instances you would be able to exceed the income of two thirds of your salary prior to retirement.

This is a good outcome….. right?

Yes, your retirement could be financially sustainable, however, relying on a full state pension to prop up your income means that you will need to continue to work until you reach state pension age. Not to mention having to work your entire life only to receive less of an income than when you worked. In other words, when working you had all the money but no time to spend it… Now you are retired you have all the time but no money to spend.

Higher rate tax payer:

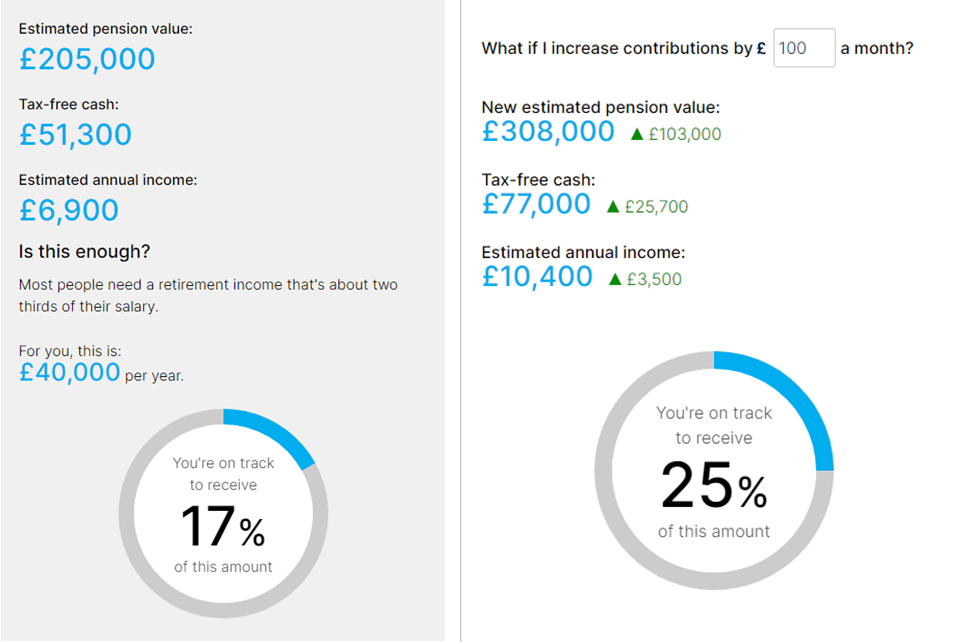

With this scenario we have taken a salary of £60,000 per year with a monthly contribution of 4% which works out to £200 and will increase to £250 after basic rate tax relief. (An additional 20% will be able to get re-claimed via self assessment.)

The grey box shows the value of a pension pot by investing just 4% of your gross monthly income, whereas the white box shows the value of a pension with an additional £100 per month contribution.

As before, by just relying on a personal pension the income you could receive would be a fraction of what you earnt when employed.

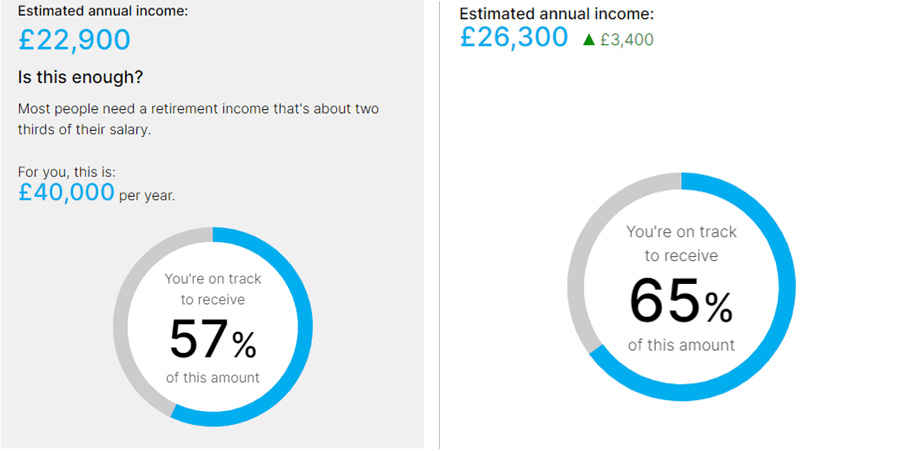

The downside for those that are higher rate tax payers is that even when you add the state pension, your income after retirement could be impacted significantly as shown below.

As a higher rate tax payer it is vital that you prep for retirement as your standard of living could be dramatically reduced by poor planning.

Is it all just doom and gloom?

All the figures above are referring to a personal pension. To be able to contribute to a personal pension you would need a salary which you can only obtain through employment. Being employed has its perks such as a workplace pension which would run side by side with your personal pension and your state pension.

With that being said, it is possible that you would be able to rely on your workplace pension being topped up with your state pension for an income and the figures above could act as a big spending pot to enable the retirement of your dreams.

When should I start saving?

The simple answer is it is never too late to start saving money, however, in order to receive the maximum benefit from your savings it is always advisable to start saving as early as possible.

When saving and investing for retirement, it’s also important to consider factors such as your age, income, and risk tolerance. As we are independent financial advisers we can provide personalized advice and guidance to help you make the most of your retirement saving and personalise it for you and your families own requirements. Click here to get your free consultation.

Overall, saving and investing for retirement is a crucial part of financial planning, and can help you achieve financial freedom and independence in your golden years.

*Please note investing in the stock market involves an element of risk of loss and is not suitable for every investor. The valuation of investments may fluctuate, and, as a result, clients may lose more than their original investment. All values stated above are estimates and not guaranteed, this information has been gathered from Hargreaves Lansdown pension calculator.

**Please be advised this does not constitute advice and is for information purposes only.

Recent Comments